A New Chapter

Suzanne Nam 12.24.07

http://www.forbes.com/global/2007/1224/044.html

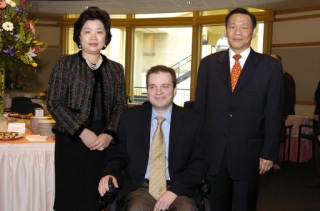

For five years Edwin Soeryadjaya battled Indonesian billionaire Sukanto Tanoto for control of coal producer Adaro. His recent legal victory helped him hold on to his spot among Indonesia’s 40 Richest and restore his family’s reputation.

On Sept. 21 Singapore’s high court ruled that Edwin Soeryadjaya’s holding company had fairly acquired shares in Indonesia’s second-biggest coal producer, Adaro Indonesia. “My first thought was, ‘Hallelujah,'” says Soeryadjaya.

After five years of legal challenges by one of Indonesia’s richest citizens, Sukanto Tanoto, questioning whether he’d conspired with Deutsche Bank AG to buy the coal interest at an unfairly cheap price, Soeryadjaya’s name was cleared. He and the investors who put up money along with him would get to keep their shares, worth perhaps ten times the initial investment. Soeryadjaya’s own fortune of $250 million, of which Adaro represents more than two-thirds, would remain intact, thus securing him the 29th rank of Indonesia’s 40 Richest.

The legal victory also helped restore some glory and respect to his family. Once one of the country’s richest families, worth $2 billion in 1991, its fortune had been wiped out by debts incurred by his older brother Edward. “Adaro has been very important to us, and we’re happy with the outcome,” says Soeryadjaya.

At times it seemed an improbable outcome. “He [Tanoto] is a multibillionaire,” says Soeryadjaya, 58, who is worth one-twentieth as much as Tanoto, Indonesia’s second-richest person. “I’m the son of a former billionaire, but I’m just a working man.” The purchase of the coal mine was contested from the start. Tanoto and others, through a Singapore investment firm called Beckkett Pte, had pledged the 40% stake in Adaro to Deutsche Bank as collateral for a loan that had been in default since 1998, at the peak of the Asian crisis. Back then coal prices were depressed and Adaro was losing money. Negotiations had broken down and Beckkett’s representatives had allegedly told Deutsche it wouldn’t get its money back. So the bank began looking for an Indonesian buyer (as required by regulations) willing to take on Tanoto. With little to lose, Soeryadjaya, who by then was an active, albeit small-time, investor, led a group who paid $46 million, through holding company PT Dianlia Setyamukti, for 40%. Deutsche Bank got the deal approved by an Indonesian court. Dianlia later upped its stake to gain a majority interest; Soeryadjaya became Adaro’s president commissioner and a board member.

Tanoto’s firm didn’t get wind of all this until the sale was complete, something Deutsche stated in court documents was necessary to make sure the firm wouldn’t intervene. Beckkett got the court to overturn its approval. It also sued Deutsche and Dianlia, in Singapore (as the original loan agreement was governed by the laws of the city-state), alleging that the two parties had secretly conspired together to sell the assets at well below market value.

At one face-to-face meeting during the trial, Tanoto personally demanded the shares back. When asked about the incident, Soeryadjaya laughs, “You’ll have to ask Tanoto about that part. I have no hard feelings.” The same can’t be said of Tanoto, who has lost a valuable asset. Since the transaction coal prices have doubled. Indeed, Adaro is now probably worth $1.2 billion, up tenfold since 2002. “Of course I met with him as we all know the truth as to who owns the shares,” says Tanoto. “I believe and continue to believe that this will eventually come to light.” But the court awarded Beckkett only a token $665 from Deutsche, for not undertaking the sale of shares in a proper manner. And it ordered Beckkett to pay Soeryadjaya’s legal fees for the conspiracy claim. Beckkett is appealing.

The irony of the case is just how much Soeryadjaya could relate to Tanoto’s predicament. After all, Soeryadjaya would probably never have invested in Adaro had his family not lost its company to lenders. His father founded Astra in 1957 and built the automotive group into Indonesia’s second-biggest company. When Soeryadjaya’s older brother Edward decided to venture into banking, starting Bank Summa, William backed the loans with Astra shares. The father continued to support his son’s bank even as it spiraled deeper into debt. Indonesian regulators closed down the bank’s operations in 1992. After scrambling to find a way to keep control of Astra, William liquidated the family’s entire 76% stake to make good on Summa’s debts. The buyer was a consortium including fellow Indonesian rich lister, the Liem family, whose fortune is now listed under the name of son Anthoni Salim.

Soeryadjaya hints the family probably could have avoided paying Summa’s debts had they chosen to aggressively challenge the creditors, the route that many of Indonesia’s wealthiest families would pick a few years later during the 1997 Asian economic crisis. The Nursalim, Salim and Widjaja families all apparently cut favorable deals with banks to greatly reduce their debt. Eka Tjipta Widjaja and his family, for instance, managed to hold on to most of their fortune and are now worth $2.8 billion, despite the fact that their Asia Pulp & Paper infamously defaulted on more than $10 billion in debt in 2001. “In Indonesia, people get away with that sort of thing. No one pays a price for it; it’s just business as usual,” Soeryadjaya says.

But Soeryadjaya’s father, who had a strong distaste for cronyism, owned up to Bank Summa’s debts, publicly announcing that the family would not shy away from its obligations, even if it meant the end of the Soeryadjaya empire. “We would be billionaires, but we took responsibility for Summa’s failure,” says Soeryadjaya.

After the debacle Soeryadjaya went to work, in part to reestablish the family’s credentials. (“It wasn’t really about the money,” he says, insisting his lifestyle hadn’t changed.) Although the U.S.-educated son had been a vice president and board member of Astra, he jokes that he never had to work a day in his life before the family lost Astra. “I went to board meetings and nodded my head yes or no, but it didn’t really matter what I did,” he explains.

He got his start pooling money from high-net-worth friends and investing it into Indonesian infrastructure and natural resources companies. His first deal was a $650 million buyout of phone company Aria West, which he eventually sold to Telekomunikasi Indonesia. Soeryadjaya lost money on the investment, though all his investors who bought the debt got paid.

In 1998 he founded an investment firm, Saratoga Investama Sedaya, with Sandiaga Uno, 38, who had worked with his brother Edward. Soeryadjaya is chairman and owns 68% of the firm; Uno is chief executive and holds the rest. Saratoga’s first investment–with Newbridge Capital, the Asian arm of private equity firm Texas Pacific–was in a former Astra subsidiary, microchip company Microtronics. One of Saratoga’s biggest deals so far has been a $215 million leveraged buyout of PT Mitra Global Telekomunikasi Indonesia (MGTI), the largest landline phone provider in Java, in 2004.

Although he won’t disclose precise figures, Soeryadjaya says his firm’s returns on investment are between 30% and 40%. Only one of 15 companies in which it has invested has lost money: chipmaker Advanced Interconnect Technologies. Soeryadjaya says it was the firm’s only moneyloser–and the only deal he didn’t work on. Another deal he could never close: Saratoga tried twice to buy back Astra, with no luck.

Much of his firm’s success is tied to Adaro and the broader recovery of the Indonesian market in the decade since the start of the Asian crisis. Since buying the stake, Saratoga has helped boost its production from 18 million to 34 million tons of coal annually. It also restructured its debt in a 2005 leveraged buyout that brought in new investors such as the Government of Singapore Investment Corp. and reduced its share to 22%. Soaring coal prices helped lift Soeryadjaya’s fortunes along with those of other Indonesia rich listers, including Sjamsul Nursalim, ranked 17, and Aburizal Bakrie, who jumped to No. 1 thanks to a 600% rise during the past year in the stock of its coal company Bumi Resources.

There may still be more upside: China Shenhua Energy, China’s largest coal producer, is reportedly considering bidding for a controlling stake in Adaro in a deal that could value the company at $4 billion. Saratoga is also in talks with investment bankers to take Adaro public in the middle of 2008. As for the risk of Beckkett’s legal appeal, Soeryadjaya is unfazed: “Why would we cheat for $46 million when we didn’t cheat for $2 billion with Astra?”

Soeryadjaya is hoping to put Astra and the controversy of the Adaro purchase behind him. His firm is raising its first formal private equity fund of $300 million, set to close next year. International Finance Corp. has committed up to $25 million. Saratoga says it has raised another $65 million from investors, including CDC, formerly known as Commonwealth Development Corp. It will be a regional fund investing in Indonesia and possibly also Malaysia, Singapore, Thailand and Vietnam, places where his family saga is unknown. For now Soeryadjaya chalks up the demise of his father’s Astra and his own later success to fate. “My life is in God’s hands,” says the devout Christian. “There must be a reason for all of this.”